Trump and Xi to Meet at APEC in Gyeongju — Trade, Chips and TikTok Shape a High-Stakes Handshake

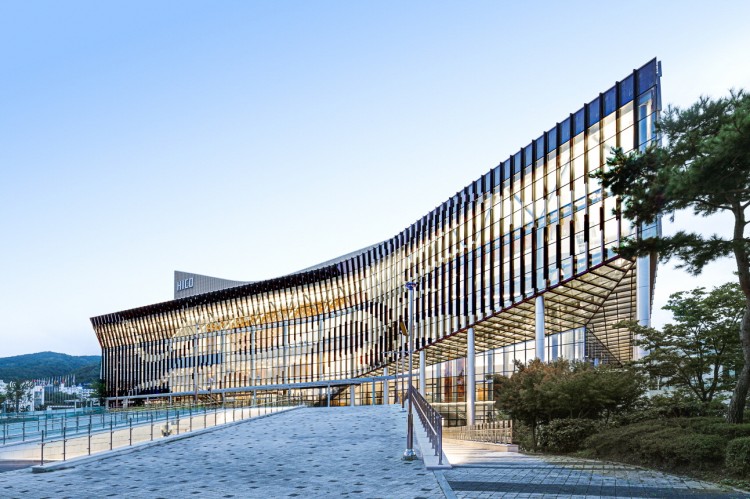

SEOUL/GYEONGJU - President Donald Trump says he plans to meet China's Xi Jinping on the sidelines of the APEC summit in Gyeongju next month, their first in-person encounter since 2019 and the centerpiece of a crowded leaders' week in South Korea. The host schedule places the APEC Economic Leaders' Meeting on Oct. 31-Nov. 1, within Leaders' Week running Oct. 27-Nov. 1 at the Gyeongju Hwabaek International Convention Center (HICO). Formal time and venue for the bilateral are pending, but the program density makes a brief pull-aside highly likely.

The meeting prospect follows a lengthy phone call on Sept. 19, after which Trump described "progress" on a TikTok arrangement while acknowledging that a final structure is not yet signed. U.S. readouts have highlighted the idea that TikTok's U.S. operations-governance and algorithm-would fall under predominantly American control, while Beijing's statements have been more guarded and stopped short of confirming a completed deal. For markets and tech platforms, any wording in summit-week readouts about a timetable or governance framework would be significant.

The setting in Korea

South Korea's hosting duties give Gyeongju unusual diplomatic gravity: Concluding Senior Officials' Meeting (Oct. 27-28), APEC Ministerial (Oct. 29-30) and the Leaders' Meeting (Oct. 31-Nov. 1) cluster leaders, ministers, and CEOs in one city, multiplying opportunities for quick sit-downs and signaling moments. The venue, HICO, anchors most high-level events, with security and logistics scaled to accommodate moving motorcades and rotating press pools. The choreography favors short, scripted leader interactions that tee up follow-through by working-level teams after APEC.

What could be on the table

Trade and tariffs remain the most visible pressure points. Both sides face incentives to reduce uncertainty for exporters without giving up leverage, which is why observers will parse phrases like "sequencing," "pilot carve-outs," or "directed technical talks" in any post-meeting notes. A narrowly scoped easing for select categories-or even instructions to explore one-would be enough to move sentiment across supply chains into early 2026.

Technology and data issues are sharper still. Washington's export controls on advanced semiconductors and tools have pushed companies to restructure sourcing; Beijing has answered with its own measures and heavy emphasis on indigenous capacity. Trump's claim of TikTok progress adds a volatile consumer-tech layer: if leaders signal a path on ownership and algorithm control that survives legal scrutiny, the headline would carry beyond APEC.

Security spillovers are likely to surface in anodyne language-hotline checks, law-enforcement cooperation on fentanyl precursors, and general references to "regional stability." Even modest guardrails can improve risk perception for airlines, shippers, and insurers that triangulate East Asia exposure into their 2026 plans.

Why Korea's vantage point matters

For South Korea, a visible U.S.-China handshake on Korean soil underscores Seoul's convening power at a moment when chips, batteries and critical materials define regional competitiveness. If the base case is a carefully scripted encounter with limited deliverables, the near-term win for Korea is reputational: a smooth summit, balanced messaging, and a platform for Asia-Pacific supply-chain resilience that aligns with domestic industrial strategy. The harder lift-any step that loosens tariffs or clarifies export-control licensing-would amplify that win and ripple quickly through listed Korean suppliers and their U.S. projects.

Timing and outlook

The leaders' sessions fall on Oct. 31-Nov. 1; additional agenda details will firm up as security plans lock and ministerial language is haggled over in the days prior. With both capitals signaling interest in stability, the most probable outcome is a short, on-message interaction that tasks working groups to keep talking. But even that baseline-paired with any TikTok governance hints-would mark a tonal shift from the stop-start pattern that defined much of 2024-25.