Korea–U.S. Tariff Talks Edge Back Into Motion as APEC Gyeongju Nears

South Korea and the United States have nudged their tariff negotiations back into motion, with Seoul signaling that an agreement before or during next month's APEC Leaders' Week in Gyeongju is still on the table. National Security Adviser Wi Sung-lac, traveling with President Lee Jae-myung in New York, told reporters the government is "keeping the summit in mind," adding that if common ground emerges, Seoul is prepared to finalize the deal without waiting for the photo-op. The remark introduces a clearer time horizon after a week of gloomier headlines.

The negotiations have seesawed since July, when the two sides reached a political understanding in principle to scale back planned U.S. tariffs on Korean goods. Local coverage describes a broad landing zone that would lower a proposed 25% rate to something closer to 15%, with the specifics tied to a Korean investment framework in the United States-shorthand in Seoul for a package often cited at $350 billion. Officials have not published a line-by-line schedule, but they have acknowledged that sequencing, oversight and financial safety valves are the hard parts.

That candor follows a public reset last week, when the presidential office said talks had stalled even as working groups kept meeting. President Lee then warned that mishandling the package could jolt Korea's currency and funding conditions, a message aimed as much at markets as at negotiators. The context matters: Seoul wants tariff clarity to anchor year-end corporate planning, while Washington wants a friend-shoring narrative that can be sold at home without spooking labor. The return to a "not deadlocked" line from Wi suggests at least a tactical thaw.

From an industry perspective, the headline is straightforward: autos would likely see the most visible shift if the rate ultimately lands near the 15% figure that Korean and international outlets have described, with electronics, batteries and materials also watching closely for carve-outs and phase-ins that avoid mid-contract surprises. That said, both governments have been careful to say nothing is final; phrases like "around 15%" reflect reported contours, not a published schedule. Businesses on both sides are pushing for explicit transition rules so pricing and logistics don't whipsaw at the start of the U.S. holiday season.

Finance officials, meanwhile, have floated currency-swap options as a cushion if the investment component creates sudden dollar demand. Analysts argue that a credible backstop would dampen won volatility and ease political resistance to the broader package. Even so, a swap is neither automatic nor guaranteed; it requires alignment with Washington's policy guardrails and would almost certainly be framed as a stability tool rather than a sweetener. The fact that Seoul is talking about it in public underscores how central funding mechanics have become to the deal's politics.

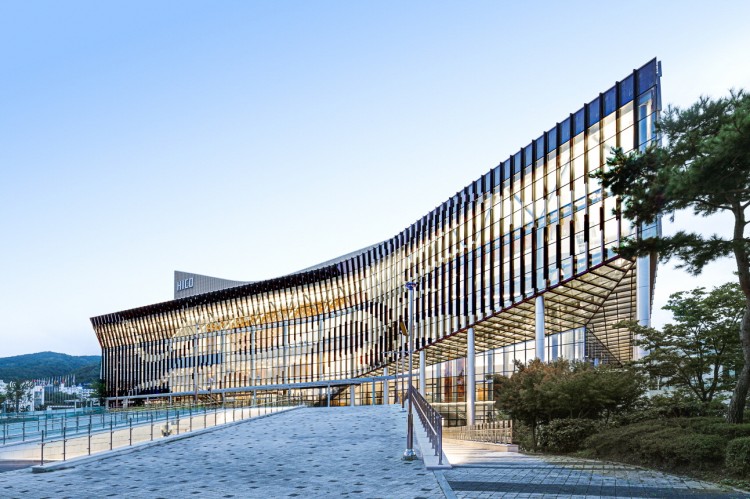

All of this funnels toward the APEC calendar, which gives negotiators natural checkpoints to register progress. Korea's host site lists the Concluding Senior Officials' Meeting on Oct. 27-28, the Ministerial on Oct. 29-30, and the Leaders' Meeting running into Nov. 1, all in Gyeongju. The schedule matters because it offers multiple windows for a narrow technical announcement, a framework note, or-if the stars align-a fuller joint statement with enough detail for companies to act on. If the week passes with only vagueness, market patience could be tested again.

For readers trying to separate signal from noise, two filters help. First, watch the verbs: "intensive," "back in motion," and "prepared to finalize" carry more weight than generic optimism, and today's comments from Wi sit squarely in that more concrete bucket. Second, treat numbers as placeholders until they appear in a document-especially tariff rates and any investment milestone schedule. The politics around those figures-how they are staged and who claims what-will be as important as the math itself.

Bottom line: after a week of "stalemate" framing, Seoul is now talking about a pre-APEC window as a live option and pointing to Gyeongju for momentum at minimum. The sticking points are no mystery-sequencing, oversight, and funding-but the clock can discipline talks in ways months of staff work do not. If the parties are truly as close as today's rhetoric implies, the next two weeks should produce language that tells manufacturers and markets how to plan for 2025.